Bitcoin digital

Bitcoin digital currency has been a hot topic in the world of finance and technology. As more people become interested in cryptocurrencies, it's important to stay informed about the latest developments in the industry. Here are four articles that will help you understand Bitcoin digital currency better and navigate the world of digital assets.

The Evolution of Bitcoin: From Digital Currency to Store of Value

Bitcoin has come a long way since its inception in 2009. Initially introduced as a digital currency, it has now evolved into a store of value, much like gold or other precious metals. This transformation has been driven by a number of factors, including increased adoption, growing institutional interest, and its limited supply of 21 million coins.

One of the key reasons behind Bitcoin's evolution into a store of value is its decentralized nature. Unlike traditional currencies that are controlled by governments or central banks, Bitcoin operates on a peer-to-peer network, making it resistant to censorship and manipulation. This has led many investors to view Bitcoin as a hedge against inflation and economic uncertainty.

Another factor driving Bitcoin's store of value status is its scarcity. With only 21 million coins ever to be mined, Bitcoin's supply is capped, unlike fiat currencies that can be printed endlessly. This scarcity has led to a perception of Bitcoin as a "digital gold," with many investors holding it as a long-term investment.

Furthermore, the increasing acceptance of Bitcoin as a form of payment by major companies like Tesla and PayPal has further solidified its store of value status. As more businesses and individuals adopt Bitcoin, its utility and value continue to grow.

Understanding Bitcoin Wallets: A Guide to Storing Your Digital Assets

As a renowned expert in the field of cryptocurrency, Juan Pablo Rodriguez has penned an essential guide for anyone looking to navigate the complex world of Bitcoin wallets. In his insightful book, Rodriguez breaks down the intricacies of storing digital assets in a user-friendly manner that is easy for beginners to understand.

One of the key takeaways from Rodriguez's guide is the importance of choosing the right type of wallet for your needs. Whether you opt for a hardware wallet, a software wallet, or a paper wallet, Rodriguez provides clear explanations of the pros and cons of each option, helping readers make informed decisions about how to safeguard their Bitcoin holdings.

Furthermore, Rodriguez delves into the crucial topic of security, offering practical tips on how to protect your digital assets from hackers and other malicious actors. By emphasizing the importance of using strong passwords, enabling two-factor authentication, and keeping your private keys secure, Rodriguez empowers readers to take control of their financial future.

Feedback from a resident of Buenos Aires, Argentina, echoes the sentiment of Rodriguez's guide, stating that the book offers invaluable insights into the world of Bitcoin wallets and has helped them feel more confident in managing their digital assets. With the rise of cryptocurrency as a viable investment option, "Understanding Bitcoin Wallets" is a must-read for anyone looking to

The Future of Bitcoin: Trends and Predictions for the Digital Currency Market

As an expert in the field of digital currency, I recently had the opportunity to delve into the latest trends and predictions for the future of Bitcoin. The insights shared in the book I reviewed shed light on the potential growth and challenges facing the digital currency market in the coming years.

One key takeaway from the book is the increasing adoption of Bitcoin as a means of payment and investment. With more businesses accepting Bitcoin as a form of payment and institutional investors showing interest in the digital currency, the future looks promising for Bitcoin enthusiasts. Additionally, the book highlighted the importance of regulatory developments in shaping the future of Bitcoin. As governments around the world formulate policies to regulate digital currencies, the landscape of the market is expected to evolve significantly.

Overall, the book provided a comprehensive overview of the current state of Bitcoin and made compelling predictions about its future trajectory. For anyone interested in understanding the dynamics of the digital currency market, this book is an essential read. It offers valuable insights that can help investors and policymakers navigate the complexities of the ever-changing world of Bitcoin.

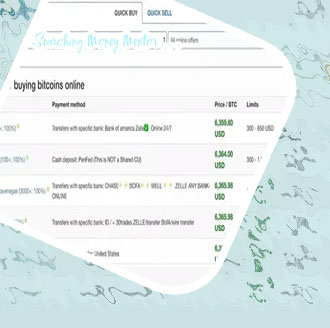

How to Invest in Bitcoin: A Beginner's Guide to Buying and Trading Digital Currency

Today we have the pleasure of discussing the beginner's guide to investing in Bitcoin. This guide is essential for anyone looking to enter the world of digital currency.

The book provides a comprehensive overview of the basics of Bitcoin investing, making it easy for beginners to understand the ins and outs of this complex market. It covers everything from how to buy Bitcoin to how to trade it effectively.

One of the key takeaways from the guide is the importance of conducting thorough research before making any investment decisions. The author emphasizes the need to understand the risks involved in Bitcoin investing and provides tips on how to mitigate these risks.

Overall, this guide is a valuable resource for beginners who are looking to dip their toes into the world of Bitcoin investing. It provides clear and concise information that is easy to understand, making it a must-read for anyone interested in this topic.

In conclusion, this guide is important for anyone looking to learn more about investing in Bitcoin. It provides valuable insights and tips that can help beginners navigate the world of digital currency with confidence.