Market cap of dogecoin

Understanding the market cap of Dogecoin is essential for investors and enthusiasts alike. By delving into articles that analyze its market cap from different perspectives, one can gain valuable insights into the factors influencing its value. Below are three articles that provide in-depth analysis and discussion on the market cap of Dogecoin.

Exploring the Factors Driving Dogecoin's Market Cap Surge

In recent months, the cryptocurrency Dogecoin has experienced a significant surge in its market cap, drawing the attention of investors and enthusiasts worldwide. This surge can be attributed to several key factors that have contributed to the coin's newfound popularity and value.

One of the primary factors driving Dogecoin's market cap surge is its increased social media presence. Influential figures such as Elon Musk and Mark Cuban have publicly endorsed the cryptocurrency, leading to a surge in interest and investment. Additionally, the Reddit community has played a significant role in promoting Dogecoin, with numerous threads and memes dedicated to the coin.

Another factor contributing to Dogecoin's market cap surge is its growing acceptance as a form of payment. More and more retailers and online platforms are beginning to accept Dogecoin as a legitimate form of currency, further increasing its value and market cap.

Furthermore, the recent volatility in traditional markets has led investors to seek out alternative assets such as cryptocurrencies like Dogecoin. This increased interest and investment have helped to drive up Dogecoin's market cap significantly.

In conclusion, the surge in Dogecoin's market cap can be attributed to a combination of factors such as increased social media presence, growing acceptance as a form of payment, and volatility in traditional markets. This article is

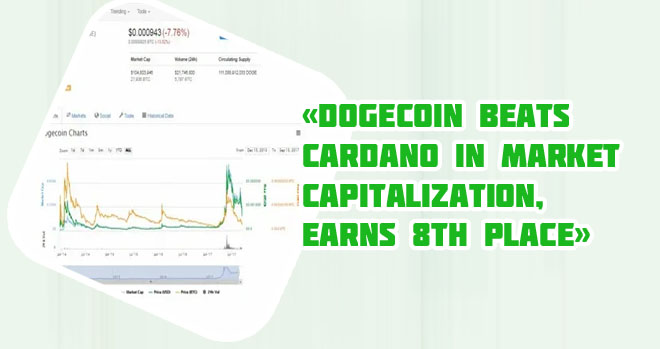

Comparing Dogecoin's Market Cap to Other Cryptocurrencies

Today we are going to discuss the market cap of Dogecoin compared to other cryptocurrencies. Dogecoin, originally created as a joke, has gained significant popularity in recent years. Its market cap currently stands at around $30 billion, making it one of the top cryptocurrencies in terms of market capitalization.

When comparing Dogecoin's market cap to other cryptocurrencies such as Bitcoin and Ethereum, we can see that it still has a long way to go. Bitcoin, the largest cryptocurrency by market cap, has a market cap of over $1 trillion, while Ethereum's market cap is around $200 billion. Despite this, Dogecoin has managed to carve out a niche for itself in the crypto market.

One of the reasons behind Dogecoin's popularity is its strong community support. The meme-based cryptocurrency has a dedicated following that has helped drive its value up. However, it is important to note that Dogecoin's market cap is still relatively small compared to other cryptocurrencies.

In conclusion, while Dogecoin's market cap is impressive, it still has a lot of catching up to do to compete with the likes of Bitcoin and Ethereum. Its strong community support and unique branding have helped it stand out in the crowded cryptocurrency space, but only time will tell if it can continue

The Impact of Elon Musk's Tweets on Dogecoin's Market Cap

Elon Musk, the CEO of Tesla and SpaceX, has been known to have a significant impact on the cryptocurrency market, particularly on Dogecoin. Over the past year, Musk's tweets about Dogecoin have led to significant fluctuations in its market cap, sometimes resulting in drastic price movements. Musk's tweets praising Dogecoin have often caused its value to surge, while negative comments have led to sharp declines.

One practical use case of the influence of Musk's tweets on Dogecoin's market cap can be seen in the profits made by traders who have been able to anticipate and react quickly to his tweets. For example, if a trader sees Musk tweet positively about Dogecoin, they may decide to buy in at a lower price and then sell when the price goes up after Musk's tweet. This could result in a profitable trade for the trader, showcasing the power of Musk's influence on the market.

It is important for investors to be aware of the impact that influential figures like Elon Musk can have on the cryptocurrency market, as their statements and actions can lead to significant price volatility. Keeping a close eye on Musk's social media activity can provide valuable insights into potential market movements, allowing traders to make informed decisions and potentially capitalize on opportunities for profit.