Dogecoin price history

Exploring the price history of Dogecoin can provide valuable insights into its past performance and potential future trends. By examining key events, market factors, and price fluctuations, investors and enthusiasts can better understand the dynamics of this popular cryptocurrency. Below are two articles that delve into the history of Dogecoin's price, shedding light on its journey from its humble beginnings to its current position in the market.

A Timeline of Dogecoin Price Movements: From Meme to Mainstream

Dogecoin, the cryptocurrency that started as a meme, has seen a remarkable journey from obscurity to mainstream acceptance. As a digital currency created in 2013, Dogecoin was initially viewed as a joke, with its logo featuring the Shiba Inu dog from the popular "Doge" meme. However, over the years, Dogecoin has gained a loyal following and has even been used to fund various charitable causes.

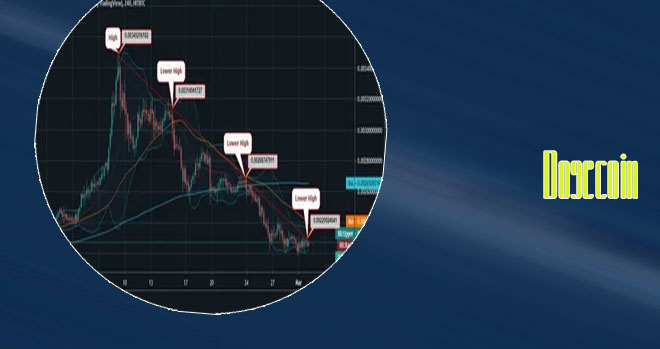

The price movements of Dogecoin have been nothing short of extraordinary. In the early days, Dogecoin was worth just fractions of a cent, making it an affordable and accessible option for many investors. However, in recent years, the price of Dogecoin has experienced significant volatility, with dramatic spikes and dips in value.

One of the key factors driving the price movements of Dogecoin is its popularity on social media platforms such as Reddit and Twitter. The community of Dogecoin enthusiasts, known as "Shibes," has played a crucial role in promoting the cryptocurrency and driving up its value.

In conclusion, the journey of Dogecoin from meme to mainstream has been a fascinating one. The price movements of Dogecoin reflect the growing interest in cryptocurrencies and the power of social media in shaping market trends. As Dogec

Analyzing Dogecoin's Price History: What Drives Its Volatility?

Dogecoin, a cryptocurrency that started as a joke based on a popular meme, has seen significant price volatility since its inception in 2013. In order to understand what drives this volatility, it is important to analyze Dogecoin's price history.

One of the key factors that influences Dogecoin's price volatility is market sentiment. Like other cryptocurrencies, Dogecoin's price is heavily influenced by news and social media chatter. Positive news such as celebrity endorsements or new partnerships can cause the price to soar, while negative news can lead to sharp declines. This makes Dogecoin particularly susceptible to sudden price swings.

Another factor that contributes to Dogecoin's volatility is its relatively small market capitalization compared to other cryptocurrencies like Bitcoin or Ethereum. This means that Dogecoin's price can be easily manipulated by large investors or whales, leading to drastic price movements.

In addition, Dogecoin's price history is also influenced by overall market trends and investor behavior. During bull markets, investors may flock to riskier assets like Dogecoin in search of high returns, driving up its price. Conversely, during bear markets, investors may sell off their Dogecoin holdings in favor of more stable assets.