Ethereum price history

Ethereum has been one of the most popular cryptocurrencies in the market, and its price history is of great interest to investors and enthusiasts alike. Understanding the factors that have influenced the price fluctuations of Ethereum over time can provide valuable insights for those looking to make informed decisions regarding their investments. To help shed light on Ethereum's price history, below are two articles that delve into different aspects of this topic:

Exploring the Factors Behind Ethereum's Price Volatility

Ethereum has been making headlines lately due to its significant price volatility. The second-largest cryptocurrency by market capitalization has seen its value fluctuate wildly in recent weeks, leaving many investors wondering what factors are driving this turbulence.

One key factor behind Ethereum's price volatility is market sentiment. Cryptocurrency markets are notoriously volatile, with prices often driven by speculation and hype. As a result, even small changes in investor sentiment can lead to large price swings. Additionally, regulatory developments, technological advancements, and macroeconomic trends can all impact Ethereum's price.

Another factor contributing to Ethereum's price volatility is the network's scalability issues. As the demand for Ethereum transactions has increased, the network has struggled to keep up, leading to congestion and higher fees. This has caused frustration among users and investors, further adding to the uncertainty surrounding Ethereum's price.

Overall, understanding the factors behind Ethereum's price volatility is crucial for investors looking to navigate the cryptocurrency market. By staying informed about market sentiment, network scalability, and other key factors, investors can make more informed decisions about their Ethereum investments.

This article is important for investors and enthusiasts looking to understand the dynamics driving Ethereum's price fluctuations. By exploring the various factors behind Ethereum's volatility, readers can gain valuable insights into the cryptocurrency market and make more informed

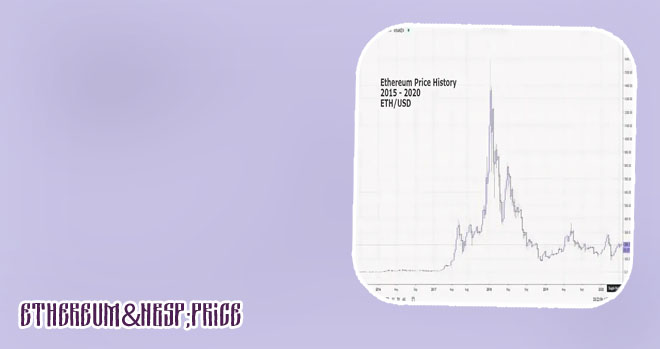

A Timeline of Ethereum Price Movements: From Inception to Present Day

Ethereum, one of the most popular cryptocurrencies in the world, has seen a rollercoaster of price movements since its inception in 2015. This timeline provides a comprehensive overview of how the price of Ethereum has evolved over the years, from its humble beginnings to the present day.

In the early days, Ethereum was trading at just a few dollars, but as the cryptocurrency market gained traction, its price skyrocketed to over $1,400 in early 2018. However, like many other cryptocurrencies, Ethereum experienced a significant drop in value during the 2018 bear market, with prices falling to below $100.

Since then, Ethereum has shown resilience and has gradually climbed back up in value, reaching new all-time highs in 2021. Factors such as the growing popularity of decentralized finance (DeFi) applications and the upcoming Ethereum 2.0 upgrade have contributed to the recent price surge.

It is important to note that Ethereum's price movements are influenced by a variety of factors, including market sentiment, regulatory developments, and technological advancements. Investors and traders should carefully monitor these factors in order to make informed decisions when trading Ethereum.