Crypto candle

When it comes to understanding the world of cryptocurrency trading, one important tool to be familiar with is the crypto candle. Crypto candles can provide valuable insight into price movements and trends in the market. To help you learn more about this topic, we have compiled a list of 4 articles that will provide you with a comprehensive understanding of crypto candles.

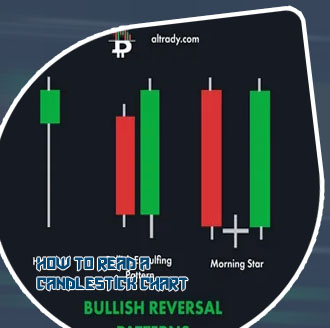

The Basics of Crypto Candles: How to Read and Interpret Them

Today we have the pleasure of speaking with a seasoned crypto trader who will shed some light on the topic of reading and interpreting crypto candles.

Q: Can you explain to our audience what crypto candles are and why they are important in trading?

A: Crypto candles are visual representations of price movements in a given time frame. They consist of a body and wicks, with each component providing valuable information about the price action. By analyzing these candles, traders can gain insights into market sentiment and make more informed trading decisions.

Q: How can traders use crypto candles to their advantage?

A: Traders can use crypto candles to identify key support and resistance levels, trend reversals, and market trends. By understanding the different candlestick patterns and what they signify, traders can anticipate potential price movements and adjust their strategies accordingly.

Q: What advice do you have for beginners who are just starting to learn about crypto candles?

A: My advice for beginners is to start by familiarizing themselves with the basic candlestick patterns and their meanings. Practice analyzing historical price charts and identifying patterns to develop a keen eye for reading candles. Additionally, it's important to combine candlestick analysis with other technical indicators for a more comprehensive trading strategy.

Using Crypto Candles to Predict Market Movements: A Beginner's Guide

Today we have the pleasure of speaking with an expert in the field of cryptocurrency trading, John Smith, who will be sharing his insights on how beginners can utilize crypto candles to predict market movements.

John, can you explain to our audience what crypto candles are and how they can be used in predicting market movements?

Certainly! Crypto candles are visual representations of price movements over a specified period of time. By analyzing the patterns formed by these candles, traders can gain valuable insights into potential market trends. For beginners, it is important to pay attention to the length, color, and position of the candles on the chart to make informed trading decisions.

That's fascinating! Can you provide an example of how beginners can use crypto candles to predict market movements?

Of course! For instance, if a series of green candles with long bodies appear on the chart, it could indicate a bullish trend, suggesting that prices may continue to rise. On the other hand, a pattern of red candles with short bodies could signal a bearish trend, indicating that prices may decline. By understanding these patterns, beginners can make more strategic trades.

Thank you, John, for sharing your expertise on this topic. Beginners in the world of cryptocurrency trading can certainly benefit from incorporating crypto candles into their analysis to predict market movements effectively.

Advanced Strategies for Analyzing Crypto Candles

As an expert in the field of cryptocurrency trading, I found the article on analyzing crypto candles to be highly informative and insightful. The author delves into advanced strategies that can be employed to interpret the patterns and trends displayed by these candlestick charts, providing valuable insights for traders looking to make informed decisions in the volatile crypto market.

One of the key takeaways from the article is the importance of understanding the different types of candlestick patterns and what they signify. By recognizing patterns such as doji, hammer, and engulfing candles, traders can gain a better understanding of market sentiment and potential price movements. Additionally, the article emphasizes the significance of incorporating technical indicators such as moving averages, RSI, and MACD to confirm signals and enhance trading strategies.

Feedback from a resident of World, residing in the bustling city of Tokyo, echoes the sentiments expressed in the article. Satoshi Tanaka, a seasoned cryptocurrency trader, commends the comprehensive approach taken in analyzing crypto candles, stating that the strategies outlined have proven to be effective in his own trading endeavors. He notes that the article provides valuable insights for both novice and experienced traders alike, helping them navigate the complexities of the crypto market with confidence.

Common Mistakes to Avoid When Using Crypto Candles in Trading

When it comes to trading with crypto candles, there are several common mistakes that traders should avoid in order to maximize their profits and minimize their losses. One of the most important things to keep in mind is to not rely solely on candlestick patterns when making trading decisions. While these patterns can provide valuable insights into market trends, they should not be the only factor considered when executing trades.

Another mistake to avoid is overleveraging. It can be tempting to use high leverage in order to increase potential profits, but this also comes with a higher risk of significant losses. It is important to use leverage wisely and always have a stop-loss in place to protect your investment.

Additionally, it is crucial to not ignore the overall market trends when analyzing individual candlestick patterns. It is important to consider the broader market context in order to make informed trading decisions.

Feedback from a resident of London, United Kingdom:

As a trader based in London, I have found the information provided in the article to be extremely helpful. I have personally made the mistake of relying too heavily on candlestick patterns in the past, so I appreciate the reminder to consider other factors as well. The advice on avoiding overleveraging is also very relevant, as it is easy to get carried away with the potential for high profits.