Do you have to pay taxes on bitcoin

When it comes to the taxation of bitcoin, many people are unsure about whether or not they have to pay taxes on their cryptocurrency holdings. To help clarify this issue, we have compiled a list of three articles that provide information on the tax implications of owning bitcoin. These articles cover various aspects of bitcoin taxation, including capital gains, reporting requirements, and potential loopholes. By reading these articles, you can gain a better understanding of how bitcoin is treated by the tax authorities and ensure that you are in compliance with the law.

Understanding the Tax Implications of Bitcoin: What You Need to Know

Bitcoin has become a popular investment choice for many individuals around the world. However, when it comes to taxes, there are some important considerations to keep in mind. Here are some key points to help you navigate the tax implications of Bitcoin:

-

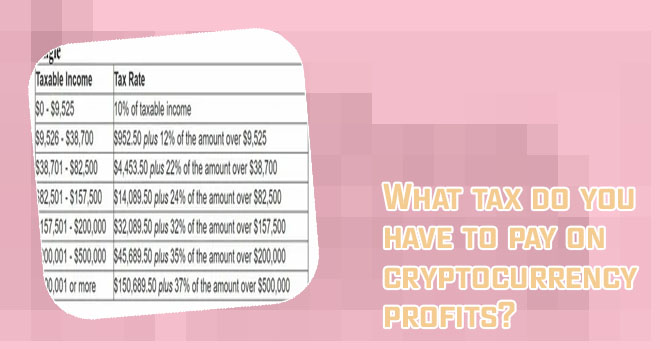

Tax classification: The IRS considers Bitcoin and other cryptocurrencies as property, not currency. This means that any gains or losses from the sale or exchange of Bitcoin are subject to capital gains tax.

-

Reporting requirements: If you have bought or sold Bitcoin during the tax year, you are required to report these transactions on your tax return. Make sure to keep detailed records of all your Bitcoin transactions, including the date of purchase, sale price, and any fees incurred.

-

Mining and staking: If you are involved in Bitcoin mining or staking, the rewards you receive are considered taxable income. You will need to report these earnings on your tax return, just like any other form of income.

-

Foreign accounts: If you hold Bitcoin in a foreign exchange or wallet, you may have additional reporting requirements. The IRS requires U.S. taxpayers to report any foreign financial accounts with a value exceeding $10,000 at any time during the year.

-

Seek professional help: Given the complexities of Bitcoin taxation, it is always a

Tax Reporting Requirements for Bitcoin Investors: A Comprehensive Guide

Today we are discussing the important topic of tax reporting requirements for Bitcoin investors with a comprehensive guide that can help clarify any confusion on the matter. This guide is essential for individuals who have invested in Bitcoin and want to ensure they comply with tax laws in their region.

The guide covers various aspects of tax reporting, including how to calculate gains and losses from Bitcoin transactions, how to report these transactions on tax forms, and the potential tax implications of mining or receiving Bitcoin as payment. By providing detailed information and examples, this guide helps investors navigate the complex world of cryptocurrency taxation with confidence.

One key takeaway from this guide is the importance of keeping accurate records of all Bitcoin transactions. This not only helps investors accurately report their taxes but also ensures they have documentation in case of an audit. Additionally, the guide emphasizes the importance of consulting with a tax professional to ensure compliance with local tax laws.

Overall, "Tax Reporting Requirements for Bitcoin Investors: A Comprehensive Guide" is a valuable resource for Bitcoin investors looking to navigate the murky waters of cryptocurrency taxation. It provides clear, practical advice that can help investors make informed decisions and avoid costly mistakes. This guide is essential for anyone looking to stay on the right side of the law when it comes to reporting their Bitcoin investments.

Exploring Tax Loopholes for Bitcoin: How to Minimize Your Tax Liability

As the popularity of Bitcoin continues to rise, many individuals are looking for ways to minimize their tax liability when it comes to this digital currency. "Exploring Tax Loopholes for Bitcoin" provides valuable insights and strategies for individuals looking to legally reduce the taxes they owe on their Bitcoin investments.

One key strategy discussed in the book is the use of tax loopholes to minimize tax liability. By taking advantage of these legal loopholes, individuals can reduce the amount of taxes they owe on their Bitcoin investments. The book provides clear and easy-to-understand explanations of these loopholes, making it a valuable resource for anyone looking to save money on their taxes.

In addition to discussing tax loopholes, "Exploring Tax Loopholes for Bitcoin" also covers other important topics related to Bitcoin and taxes. The book delves into the history of Bitcoin, famous people who have invested in the cryptocurrency, and the potential tax implications of using Bitcoin for transactions.

Overall, "Exploring Tax Loopholes for Bitcoin" is a comprehensive guide that provides valuable information for individuals looking to minimize their tax liability on Bitcoin investments. Whether you are a seasoned Bitcoin investor or just getting started with cryptocurrency, this book is a must-read for anyone looking to save money on their taxes.